Tokenomics

Tokenomics

Total Supply: The total supply will initially be 10 Billion SQT tokens.

Inflation: SubQuery Network is inflationary, you can see the current rate on the parameters page. This will be used to help the SubQuery Foundation bootstrap the network by supporting Node Operators during the early launch phase where Consumers numbers will still be growing, as well as contribute funds to the SubQuery Foundation treasury. Read more about network inflation rewards here.

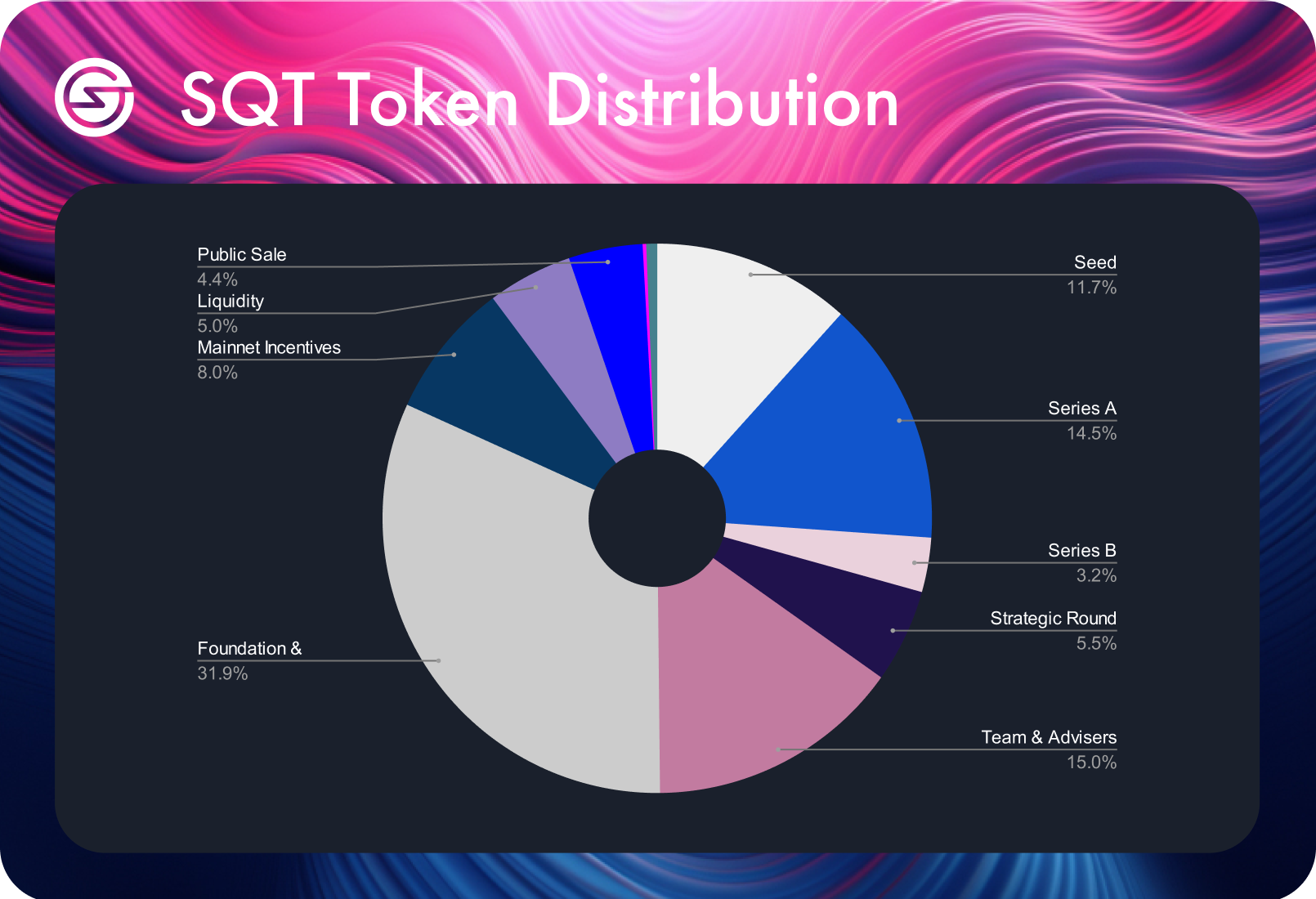

From the start, SubQuery has been focused on building value within the community and this aim continues with the largest allocation of tokens being apportioned to the Community and SubQuery Foundation for various programmes and mainnet incentives.

The SubQuery Foundation, will administer the governance and growth of the ecosystem and the ownership of the SubQuery Network will come under the SubQuery Foundation initially. This large allocation also includes consideration for future investment into the development and operations of the Network, and key ecosystem growth drivers. This will include tools such as grants and ecosystem incentives/events as well as other marketing activities including bug bounties and mainnet incentives.

Early investors in previous private investment rounds have a combined allocation of 34.8%. SubQuery is grateful for their early support and commitment to help us through the initial phase of SubQuery.

Finally, the SubQuery Team and Launch Partners have been allocated 15% of the token supply in return for their tireless dedication and contribution in building and promoting the project over multiple years of hard work.

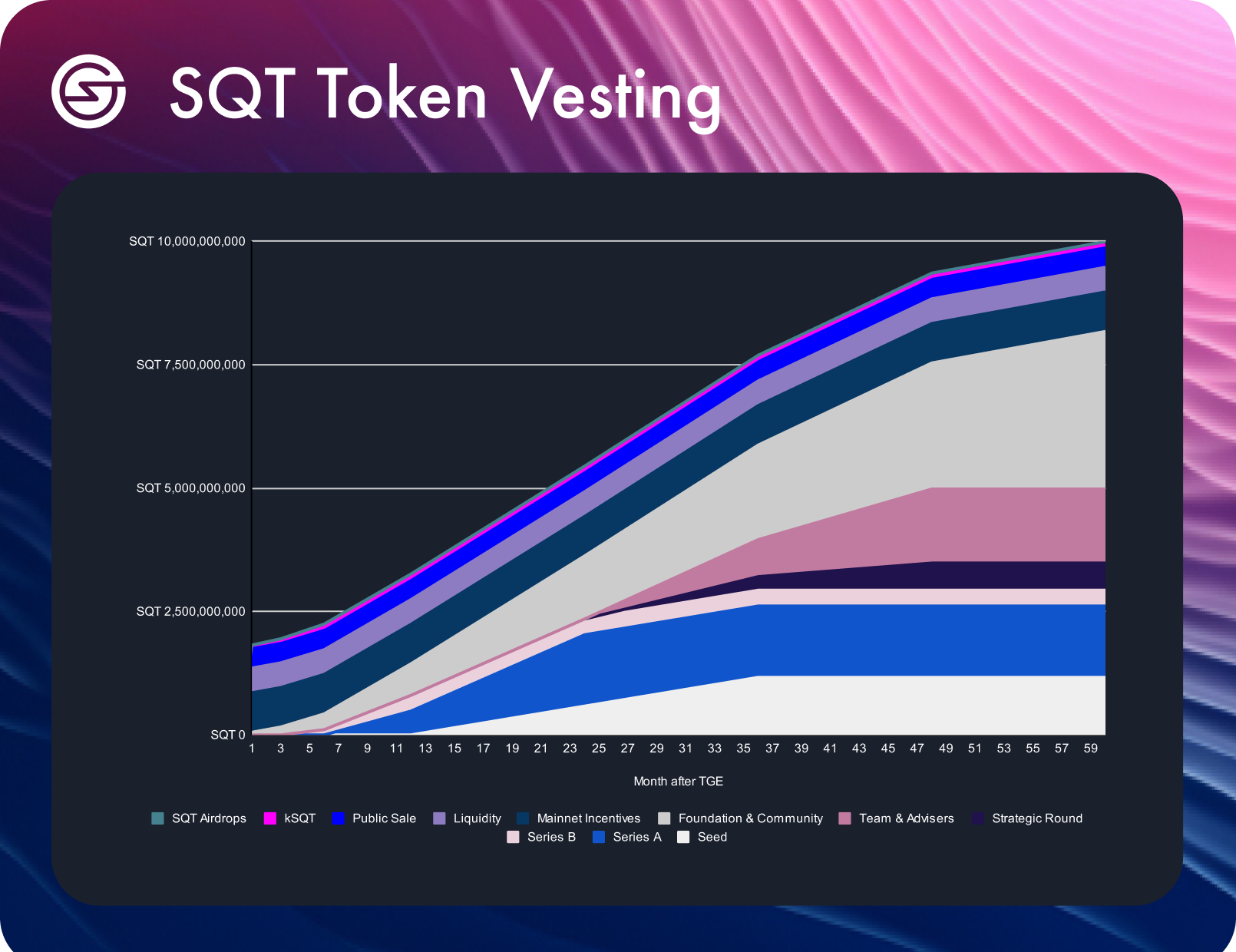

Vesting schedule

We have designed our vesting schedule to demonstrate the commitment of various stakeholders. The graphic below illustrates the planned release of the SQT tokens to each participant over time culminating in the full circulation of tokens occurring 5 years (60 months) after launch.

The vesting schedules for each participant has been designed to create long-term value for the project and generate confidence to token-holders. Perhaps most significantly, the core team will have a 24 month lock-up period which will then vest over another 24 months while some Public Sale participants can freely use the utility of their token upon launch.

The Foundation and Community will have approximately 8% of their allocation unlocked from the start (as part of mainnet incentives) to meet the operational needs of launching and promoting the SubQuery Network with the rest of the allocation vesting gradually over 5 years.

Vesting start date

Vesting schedules started when the network launched at 8am UTC, February 23rd 2024.

| Group | Size (exact) | Vesting Terms |

|---|---|---|

| Seed | 11.65% | 12 month lock-up with 24 month vesting |

| Series A | 14.49% | 6 month lock-up with 18 month vesting |

| Series B (and 2022 Private Sale) | 3.20% | 3 month lock-up with 9 month vesting |

| Strategic Round | 5.50% | 24 month lock-up with 24 month vesting |

| Team and Advisers | 15.00% | 24 month lock-up with 24 month vesting |

| Foundation & Community - Mainnet Incentives | 8.06% | No lock-up or vesting |

| Foundation & Community - Vested | 31.81% | No lock-up with 60 month vesting |

| Liquidity | 5.00% | No lock-up or vesting |

| Public Sale | 4.39% | No lock-up or vesting |

| kSQT Conversion | 0.22% | No lock-up or vesting |

| SQT Airdrops | 0.18% | No lock-up or vesting |

| SQT Seekers Programme | 0.50% | No lock-up with 6 month vesting |